Diminishing value method formula

This kind of depreciation method is said to be highly charged in. When using this method assets do not depreciate by an equal.

Written Down Value Method Of Depreciation Calculation

Every time diminished value was.

. 2000 - 500 x 30 percent 450. Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. The 17C Formula and How Insurance Companies Evaluate Diminished Value I worked as an insurance adjuster for many years at several companies.

This means the maximum amount your car can lose in value after being repaired is 1300. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. Thus the value of the equipment is diminished by Rs 10000 and becomes Rs 90000.

If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. Then you apply the damage and mileage multipliers. Prime cost straight line method.

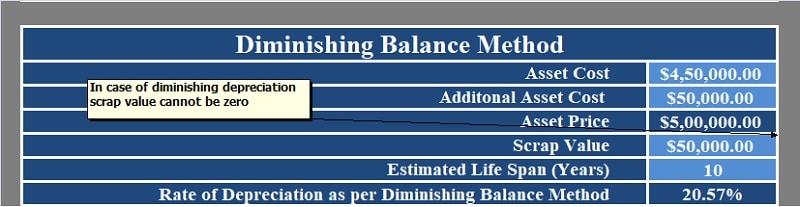

This would be applicable for both Straight Line and Diminishing Value depreciation. Diminishing Balance Method Example. The diminishing balance method is a method of calculating the depreciation expense of an asset for each accounting period.

Year 2 2000 400 1600 x. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. - Diminished Value Claim.

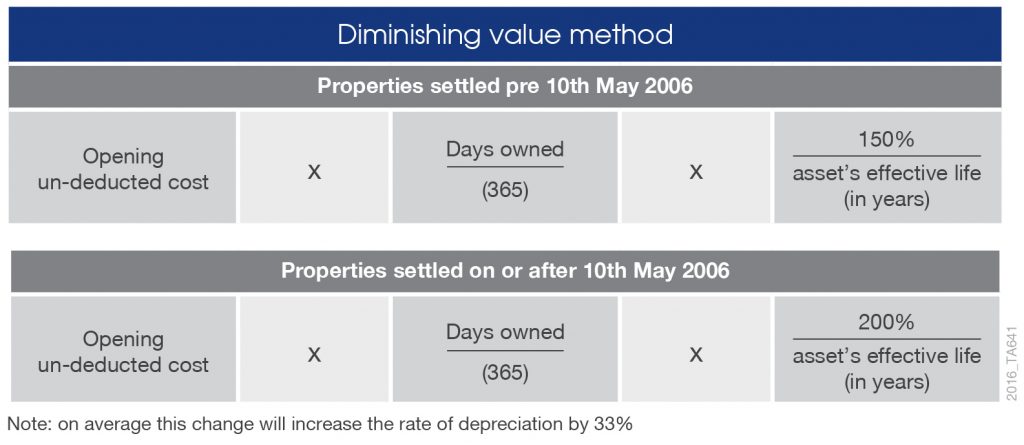

Another common method of depreciation is the diminishing value method. Diminishing value method. The diminishing balance depreciation method is one of the three depreciation methods mentioned in IAS 16.

Cost value 10000 DV rate 30 3000. In this video we use the diminishing value method to calculate depreciation. Ad Car Appraiser - Free Consultation -Available Weekends - Call Now.

Assets cost x days held. And the residual value is. This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following formula.

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. As the book value reduces every. Cost value diminishing value rate amount of depreciation to.

You might need this in your mathematics class when youre looking at geometric s. As it uses the reducing. To determine the diminished value you multiply the vehicle value by the 10 cap.

Lowball Insurance Offer for Totaled Car. For the second year the depreciation charge will be made on the diminished value ie. The diminishing balance method is a.

000 over 100000 miles. I want to put a formula in the attached sample worksheet as per below requirement. Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula.

Depreciation - 10500 calculated from 1306 300606 - But only 4 months in. 10 of 13000 is 1300. If the asset costs 80000 and has the effective life of 5 years.

If the damage to your car is assessed at 050 you would. Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value. Hence using the diminishing method.

In the first month of purchase the value will remain the same after this it will. Year 1 2000 x 20 400. Prime cost straight line method.

According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the asset.

Depreciation Calculation

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Depreciation Formula Examples With Excel Template

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Depreciation Formula Examples With Excel Template

Straight Line Vs Reducing Balance Depreciation Youtube

Written Down Value Method Of Depreciation Calculation

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Rate Calculator Online 59 Off Www Alforja Cat

How To Calculate The Diminished Value Of Your Car Yourmechanic Advice

Depreciation Formula Calculate Depreciation Expense

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Diminishing Value Vs The Prime Cost Method By Mortgage House

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Double Declining Balance Depreciation Calculator

Written Down Value Method Of Depreciation Calculation